As much as we'd like to talk about the action of this market, we can't help but wonder about one thing. As the Journal title suggests, we just want to know where people are putting their money into or will in days/ months to come? The selling has been pretty relentless in the past two trading session, today we had another ugly close into the bell (3rd/4th maybe in 1.5 week) after an already 3% decline Friday. This is in addition to the weeks of selling pressure present. The market barometer, SPX index, is literally at the brink of testing recent and perhaps 8 months low. FWIW, the recent low is around 1040, while the 8 months low is around 1020. We thought we'd get there as previously noted or lower, but this is a little sooner than thought as we've hardly touched summer yet. Forget about the actual Economy or Corporate outlook, the sentiment out there is pretty shaky. With a recent disappointing NFP# and constant reminder of Euro debt trouble, many folks are definitely having doubts of staying in this market, regardless the level. Oh yeah, 2 aspects to Friday's decline noted this weekend other than NFP were not even mentioned today. This should have calmed the markets some, but the market in Europe didn't care and either did U.S as the damage was done as of Friday!.

- Hungary - "Now the Hungarian economy is on the way to recovery and has shown the first signs of strength in the first quarter of this year. Therefore, any talk of a fiscal or debt default in Hungary is widely exaggerated."..hit the G20 newsflow.

- SOGEN- the co was apparently telling analysts that it didn’t suffer losses on derivatives –Bloomberg

Let's throw in BP finally making progress in a long time and the market still acts like crap. Yes, you can blame the NFP# than, but, even there is a possible positive there as in Census years, the private sec number jumps big in the next report after one like this. It's all interwined and we're not going into it, but this number may not tell the whole story. So, what is it? .

Irrational pessimism? We think that's a little understatement at this point. Right now the only near term catalyst for this market is fear and more fear. Even though many of the potential hazards and concerns that are on people's mind may or may not materialize, but action speaks louder than words. People are voting to stay on the sideline and not to participate.

We have been pointing out for a long time that this is grinder sort of Economy and market. The recovery road is going to be a long process which underscores how severe the mortgage and financial crisis have hit us a year and half ago. Being skeptical of the recovery is definitely a natural behaviour when you are faced China markets correcting over 20% (slowing growth questions), a disappointing NFP# report or negative headlines out of Europe. However, we feel it's prudent to give this market and Economy a little time before jumping into any extreme conclusion. We may be in the minority camp when it comes to this market today, we also feel the market has discounted most, if not all of the concerns out there.

Bottom line, with 0% interest rate for many many months to come, we just wanted to know if people are seriously content about putting their money under their pillow.

Still, as of Friday, we're seeing flow out beta small caps...is it rotation?... liquidation/ even margin calls etc. as we've seen in commodities already. We'll see soon enough.

Yes, the Iphone 4 couldn't save the world today ... but...

- There's a Euro finance meeting tonight, another tomorrow of all EU and possibly some things will be cleared up. ECB later this week. Something will give here in Europe this week and will be a positive catalyst for the markets or else...

Monday, June 7, 2010 at 06:44AM

Monday, June 7, 2010 at 06:44AM

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

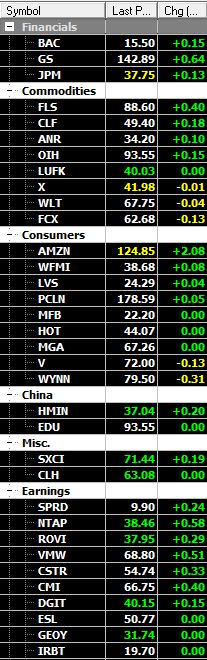

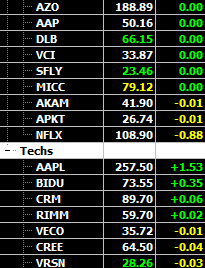

Email Article | tagged  AMZN,

AMZN,  AZO,

AZO,  CRM,

CRM,  FFIV,

FFIV,  LVS,

LVS,  NTAP,

NTAP,  ROVI,

ROVI,  SPRD,

SPRD,  SXCI,

SXCI,  VMW,

VMW,  WFMI,

WFMI,  WYNN

WYNN