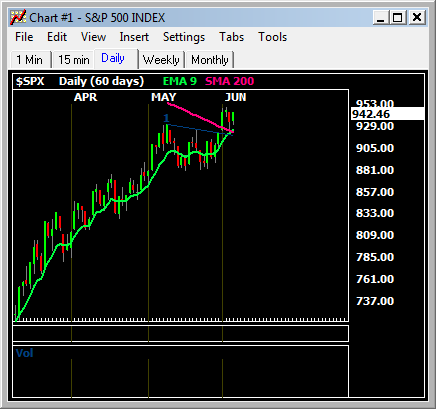

Every couple of trading days, we get a day where the Bears seem to have an upper hand in the early going, ONLY to give back all their gains in the final hour. In fact, this isn't a new episode we witnessed today, but a pretty consistent show that comes every few days for a couple of months now. Since March, we’ve been pointing out an underlying bid at 20MA coming in, now it’s seemingly ~200MA levels on day 6 over this important technical level. We were still quite short of the 919SPX present day 200ma (7pts). Today, overwhelmingly an underlying bid came where the breakout occurred last Monday‘s (200ma level). Even on those days where the Bears do claim victory, a failed follow through day puts the ball right back into the Bull camp. It’s never-ending and frustrating to say the least, for those Bears. If this hasn't been a continuous classical buy on dip kind of rally, we don't know what is!. In fact, all these little mini back and forth action simply put this rally in a much healthier state than the Bears would ever hope for as we grind higher.

Still, as we said 950, even 940+ is quite formidable for the Bulls for now without a positive catalyst. Also, putting the move 3pm move into context, it was following a very low volume day to that point and the ensuing move was purely SPY and a few other ETF’s related. You will understand this as you look at your ‘shadow list’ and see little follow through/ little movement in individual stocks/ sectors after 3pm. One sided move so far, we would like confirmation by seeing some follow through action in Asian/ FTSE mkts in am before getting too excited for more, just yet.

This is, in fact, is a Bull run that gives us plenty of opportunities. As long as you trade with the trend, not with your feeling, and not with your disagreement with the state of the economy or policy makers, you'd be doing fine so far. Is there manipulation in this market by the market makers eg. JPM, GS or policy makers as cried by the Bears? So what if there is!! If you are a trader and consumed by visiting blogs to clog your mind,"blogs that clog", you will see these useless cries. Think about for a second, if you have another gig to worry about other than trading and come home in the evening, what do you see?. You see a market going up and up, that’s all !!. Sonner than later, you call your broker to buy!. If you read the WSJ, your local financial print or just tune into CNBC, you don’t hear this manipulation noise. We are simply here to trade with the majority (trend), regardless of what the minority opinion is on the 'net'. The most ridiculous aspect of these ‘conspiracy’ theorists, is if they believe it sooooo’ much and are so sure it is pushing this market higher for weeks now …why do they not just trade this trend up and make money off it!. It's a daily laughing matter to us to visit these characters when we don't have nothing better to do sitting in front our platforms for hours on in daily.

In this market, it's not our personal opinion that matters on the bigger picture, it's the majority of everyone else' opinion (money) that matter.

As far as individual stock action goes, we are still finding a lot of good dip opportunities from our earnings plays. SAFM ARUN STEC BWY GMCR.. all were making fresh highs today, some dip a little, some don‘t. Most of the Chinese plays look buyable too on dips. If you are uncomfortable or unsure about some of the commodity dips, then it's ok not to buy them. After a few days of strong $USD ruckus, we may have a good commodity linked trade back very soon. Not counting Oil/energy plays related to(if) higher crude prices, we'd stick to 'steels' over the other linked commod' groups. In the meantime, we have plenty of "sure" plays on our list that can be justified as safe dip buys, only problem is some don't dip and that's why it's essential to do quality 'stock picking' early to make the bigger dollars as has been the case with our small cap 'earnings' plays this Q.

In AMC newsflow, TXN guided higher on a optimistic call. We are wondering if this is a sign to come for many tech' companies. After all, if there's some growth business segments from a big one like TXN, it has to be the same case for many other smaller players. Basically, we don't expect TXN to be the last one to pre-announce good guidance, we already had CREE be the first recently. Bottom line, the ball is seemingly never in Bears' court for long. It’s hard to press new shorts lower and lower because it's hard to get their brothers and sisters to do so when the declines only last a few hours, or a day. As we said, the volume is light across the tape today indicating the shorts are not confident to press new positions even when down big for a few hours. We are hoping for some more grinding action in order to set up a more powerful leg up down the road. Yup, still...that's our 'bullish' plan.

Friday, June 5, 2009 at 06:18AM

Friday, June 5, 2009 at 06:18AM