If we were doing a simple daily recap as many trading wordsmith's do daily, we’d talk some jibberish about how indecisive, boring a (-0.16 to +0.16) day in the major indicies was. But, at the DJIM, the Journals are a methodology behind a trade, a set up/prep for the next trading day/ week etc.. What’s written here, is what is on the brain to trade!. DJIM is looking at the same things /ideas as what’s written about. So, let’s see how yesterday’s Journal can be used into a trading day.

Unfortunately, we’ve (market) has become polluted with the USD/EURO trade. Yes, the same trade we said would be effect since early September and than when Euro was near crucial support at ~1.27. (1.40 premkt heights before unwinding some and diving ). Now, the Euro probably has a Facebook page or even it’s own Twitter account, but it’s ‘boring stuff’ here as we called it yesterday discussing the USD EURO-ADP #. As a blind mouse can see if (bad) ADP report helps USD, so a (good) Initial claims # hurts USD. This is exactly when the happy Euro, USD reversed today and changed the whole make up of the day after the claims #. Of course, commodities and its underlying stocks became expendable and sold off. You can scalp this till you are in blue in the face now, if that’s your schtick!. As far as tomorrow’s NFP#, the preceding ISM’s employment components, ADP #’s, Initial claims have really muddled the picture that it’s likely to end up a non-event and not hurt QEII’isms’. Fear of an surprise upside # tomorrow has faded since we talked last about it a few days ago. It’s when you don’t think you should worry about it, it hits you in the face..eh?. At this point the risk of getting a temporary technical recovery in the USD is great, so the believe that this is a win-win number and that a surprise upside is good news as well (economy) is not boding well here at an oversold USD.

*On the FX wars topic, IMF meet up this weekend. Even though the chances are very remote of any agreement, if anything does happen, we’ll likely wake up Monday to an unpleasant surprise.

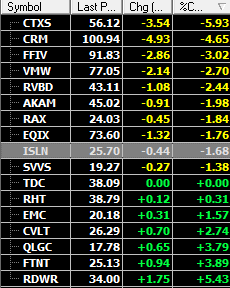

The notable part from yesterday’s trade was the momo liquidation. Of course, everyone was writing about it last night as a fill in for space, but what was suggested here is there is a trade here to look for…. It was expressed in…..“Do shorts, who did press today, or the acquiring executives at IBM, HPQ DELL, CSCO know better…. One good report, one acquisition and it will be sunny and not cloudy days in the forecast”. The point is this where DJIM is looking for trades the next day to start. It’s not a recap. Well, it didn’t look like the shorts had the guts to press further, a quick glance at the names given yesterday shows they found footing early and all finished well off their lows and many green. Oh, look ADBE BMC acquisition rumors hit for good luck too!. Oh yeah, IBM hit a NCH dating back to B.C.

So, on a day flat, if you wanted to trade, you had commods’ to intraday trade with Euro swing or the beaten up momo’s, if you saw support in the tape as shorts stopped to cover.

* Still note this liquidation is very possibly a hint of things to come in the broader market in the way of a short term correction. Buyers are stepping up the last few days, but if we have a 'decent' size down day where they don't appear by close, don't expect them to come back until things really settle down. This has been the make-up of the market as we've pointed out on many occasions this year.

Overall, a 'defensive' stance as the market 'stalls' out. If you recall it was discussed a few weeks back (below 1130) that overbought/ optimistic readings can last longer and they have. Unfortunately, the longer is becoming shorter and shorter now and so, we'd concentrate on new emerging EPS linked stocks going forward.

Tuesday, October 5, 2010 at 07:57AM

Tuesday, October 5, 2010 at 07:57AM